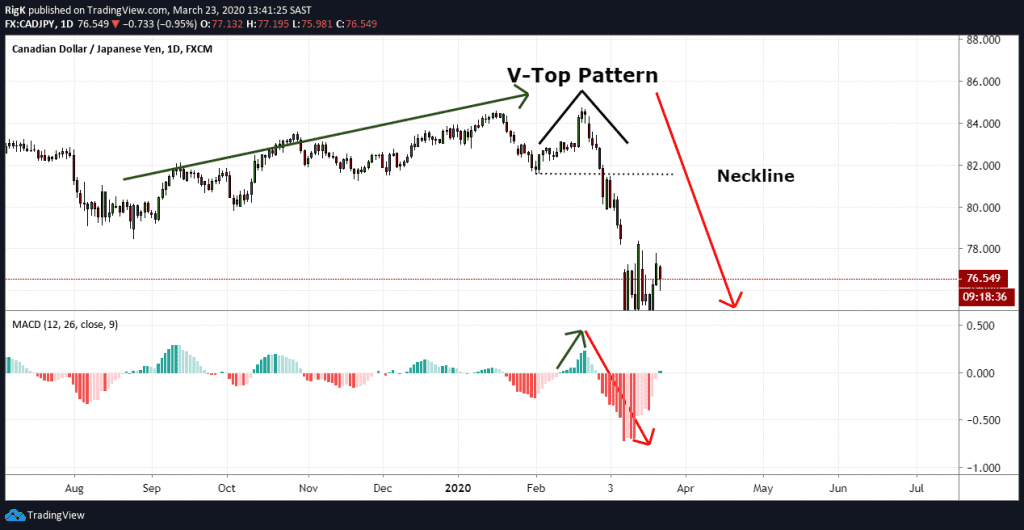

31/03/ · The fundaments for today are in line with a long position on this pair. The state of the market on the 1H was a range, but the price broke this range. Price broke the highest price of yesterday's New York session with 60%. This breach has a fibonacci pullback of 61,8%. on the 3m chart there's a v-formation with several test and sellers getting 23/06/ · V tops and V bottoms are chart patterns that are easy to spot after they have completed. They appear just like their names suggest, V-shaped or inverted V-shaped price patterns on the chart. See also Extended V Tops and Extended V Bottoms. My book, Encyclopedia of Chart Patterns Second Edition pictured on the left, takes an in-depth look at Missing: v formation 01/07/ · The V-Top Pattern and How to Trade it. The V-top pattern gets its name from the upside-down V shape formation and appears when price momentum switches from an aggressive buying to an aggressive selling state. This pattern is a powerful bearish reversal chart pattern and appears in all markets and timeframes but due to the nature of the fast

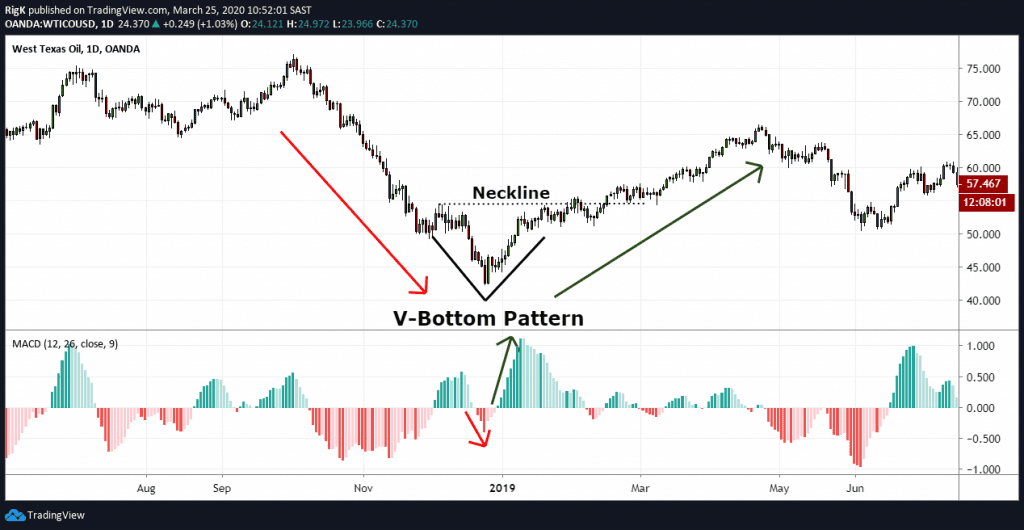

V-Bottom Chart Patterns: Ultimate Trading Guide - PatternsWizard

Classic patterns. The v-bottom pattern got its name from the v-shaped pattern. This pattern comes up when price momentum moves from an aggressive selling to an aggressive buying condition.

Quick signal that a v-bottom is appearing would be the availability of a v formation chart pattern — 3 bar reversal. Followed by an increment in momentum and volume during the downswing that makes up the low and the present upswing that follows, v formation chart pattern.

Even though it barely happens, it can be a different type of indication that affirms a v-bottom is developing. This occurs most especially when you begin observing an increment in purchasing pressure afterward, v formation chart pattern.

Monitoring the price action by adopting different periods can, therefore, be handy when you perceive a v-bottoming is coming. A conservative means to trade the v-bottom would be to exercise patience for a break and close beyond the resistance level. And to try a bullish position immediately price returns back to the resistance level and a decline happens.

You can place a suitable target beyond the resistance level, same as the distance calculated from the low of the formation to the resistance level high. Confusion will occur regarding where the support level should be. But experienced investors who have seen this v-bottom reversal quickly enough may have tried bullish positions. Make use of any swing that forms in the course of the previous selling stage.

It is not new to us all that SPY attained another strong long stage after v-bottom traded higher for the rest of Trading v-bottoms can be hard because you will only probably be able to identify this pattern immediately price breaks beyond the resistance level but if you observe the momentum closely as well as volume, then they can be quick signals that a v-bottom is coming.

A v-bottom has a very sharp trough. Traders hurriedly lead to a rapid price drop, v formation chart pattern, then a full retracement of the short movement in the aftermath.

A v-bottom frequently shows up following an economic announcement that caught the trader unaware, v formation chart pattern. This is an indication of high volatility, v formation chart pattern. Why hope for your trading to work when you can precisely know the performance stat of every pattern? Do you want to follow a great video course and deep dive into 26 candlestick patterns and compare their success rates?

Then make sure to check this course! A step by step guide to help beginner and profitable traders have a full overview of all the important skills and what to learn next �� to reach profitable trading ASAP. First Name. Get All Tips for Profitable Trading. A descending triangle forms with an horizontal resistance and a descending trendline v formation chart pattern the swing highsTraders can The double bottom looks like the letter "W"Price touches twice a support levelThe double bottom pattern follows a A symmetrical triangles forms when the price of a security consolidates between two trend lines with similar slopesIt The double top looks like the letter "M"Price touches twice a resistance levelThe double top pattern follows an The ascending triangle pattern is a continuation pattern.

Price typically breakout in the direction of the prevailing A rising wedge forms when two converging upward slope trendlines encapsulate the priceIt is a bearish pattern What is Pre-register now and receive the candlestick patterns statistics ultimate ebook for free before anyone else!

V-Bottom Chart Patterns: Ultimate Trading Guide Classic patterns. Find The Best Candlestick Pattern Now. First Name Email Get All V formation chart pattern for Profitable Trading. Want to know which markets just printed a pattern? Market Timeframe Printed on. Related articles you will like. How to trade the Descending Triangle pattern? Get the ebook to know the stats. I want the book before anyone else for FREE!

�� The Only CHART PATTERNS Technical Analysis \u0026 Trading Strategy You Will Ever Need - (FULL COURSE)

, time: 15:00V Tops and V Bottoms

31/03/ · The fundaments for today are in line with a long position on this pair. The state of the market on the 1H was a range, but the price broke this range. Price broke the highest price of yesterday's New York session with 60%. This breach has a fibonacci pullback of 61,8%. on the 3m chart there's a v-formation with several test and sellers getting 24/04/ · V bottom patterns are a bullish pattern that look like the name that they are called. Price moves up to a peak level and then starts to pull back or fall rapidly. Once price has found a base, it makes a sharp pointed reversal to the upside. Then, price goes back up to the 1st peak level. Look for breakout at top of v to confirm continuation 01/07/ · The V-Top Pattern and How to Trade it. The V-top pattern gets its name from the upside-down V shape formation and appears when price momentum switches from an aggressive buying to an aggressive selling state. This pattern is a powerful bearish reversal chart pattern and appears in all markets and timeframes but due to the nature of the fast

No comments:

Post a Comment