In the forex market, futures markets and other financial markets, the term “lot” specifically refers to the smallest available position size or unit that can be traded in those markets. The specific amount of currency assigned to a lot is known as a lot blogger.comted Reading Time: 13 mins There are three types of lots (by size): Standard lots = units Mini lots = 10 units and micro lots = units. Mini and micro lots are offered to traders who open mini accounts (on average from $ to $) 2/10/ · The smallest lot size in forex is called a microlot and it’s worth 0,0. There’s then the minilot which is 0,1 and it’s the medium size. However, there’s no limit to the highest amount – even if some brokers set a maximum of 20 lots for every single trade blogger.comted Reading Time: 4 mins

Choosing a Lot Size in Forex Trading

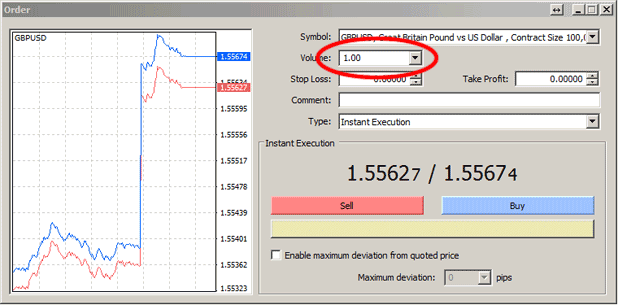

What is a lot? A lot is the smallest available trade smallest lot size forex that you can place when trading the Forex market. The brokers smallest lot size forex point to lots by parts of or a micro lot.

You have to know that lot size directly influences the risk you are taking. Hence, finding the best lot size with a tool like a risk management calculator can help you determine the desired lot size. It has to be based on the size of your accounts. No matter if you exercise or trade for real. You must understand the amount you would able to risk, smallest lot size forex.

In the stock market, lot size refers to the number of shares you buy in one transaction. In options trading, lot size signifies the total number of contracts contained in one derivative security. The theory of lot size allows financial markets to regulate price quotes.

It basically refers to the size of the trade that you make in the financial market. With the regulation of prices, investors are always aware of exactly how many units they are buying an individual contract. Hence, they can quickly evaluate what is the price they are paying for each unit. As it is already written in our previous post, currency movements are measured in pips and depending on your lot size a pip movement will have a different monetary value.

In Forex, 1 standard lot refers to the volume of So when you buy 1 lot of a forex pair, that means you purchased When the leverage goes higher, the margin you need to open the trade goes lower, smallest lot size forex. Every trader must define the volume of the trades based on own risk perception.

Of course, it is reasonable sometime to open trades under 1 lot using the mini lot, micro lot and nano lot. Suppose you are new in forex trading, it is strongly recommended to use mini, micro or nano lots to avoid big losses, smallest lot size forex. Thus, when you open 0. If you are a novice and you want to start trading using mini lots, smallest lot size forex, be well capitalized. When you trade 0. A micro lot is a portion of units of your accounting funding currency, smallest lot size forex.

If you are trading a dollar-based pair, 1 pip smallest lot size forex be equal to 10 cents. Nano lot, named cent lot by some forex brokers, is equal to either or 10 units. In some forex brokers, nano lot refers to 10 units while in some other brokers, it may refer to units.

Truly, only a few brokers offer this option as an account type such as FXTM and XM. Nano lot is the safest way to trade if you are a novice trader or if you want to test a new trading strategy.

You can go through the training process with much less risk and loss. Also, if you bought a new expert advisor or are trying a new trading strategy, it is smart to use nano lot for the first few weeks. Just in order to avoid big losses, smallest lot size forex. It is smart to likening the lot size that you trade and how a market move would affect you to the amount of support you have when something suddenly happens.

When you place an extremely large trade size relative to your accounts, you can be faced with many troubles, smallest lot size forex. Even small movement in the market smallest lot size forex send a trader the point of no return. Save my name, email, and website in this browser for the next time I comment. FREE Price Action PDF Home Magazine Trading strategies app Start Here Trading Dictionary About Contact.

A lot is the smallest trade size that you can place when trading the Forex market. When unsure what's the right move, you can always trade Forex Get the number 1 winning technical analysis ebook for trading Forex to your email. Containing the full system smallest lot size forex and unique cash-making strategies. You'll be surprised to see what indicators are being used and what is the master tuning for successful trades.

Including case-studies and images. Forex lot lot size micro lot mini lot nano kot trading what is lot size in forex. Leave a Comment Cancel reply Name. I agree that my submitted data is being collected and stored. For further details on handling user data, see our Privacy Policy.

You May Also Like. Read more. What Are The Best Days For Forex Trading And Why? Indian stock market is worthy to invest. Goal-based investing — How Does It Work? Investment Portfolio Rebalancing — Why Should We Do That? Close this module Price Action Trading - Myths and Truths Price Action Trading Blueprint. Get INSTANT ACCESS Here. Share on Facebook Share on Twitter.

What are the meaning of Lot Size in Forex Trading - Know about Lot Size - hindi - Tube Guru

, time: 9:11Forex Lot Sizes and Risks | Forex for Beginners

Mini Lot size Suppose you are new in forex trading, it is strongly recommended to use mini, micro or nano lots to avoid big losses. Mini lot is equal to 10% of standard lot ( x = units). Thus, when you open lot, you will trade 1 mini lot. With every mini lot, the worth of 1 pip for EUR/USD equals to $1 4/4/ · To trade $ in Forex, a lot size is recommended. A $ lot is also called a micro lot. Even though $ is a small amount of capital, it is still enough to get you started trading. It would be best if you always traded by managing your risk, and for beginners, we recommend you risk no more than 2% of your investment blogger.coms: 1 Lot in forex represents the measure of position size of each trade. A micro-lot consists of units of currency, a mini-lot units, and a standard lot has , units. The risk of the forex trader can be divided into account risk and trade risk

No comments:

Post a Comment