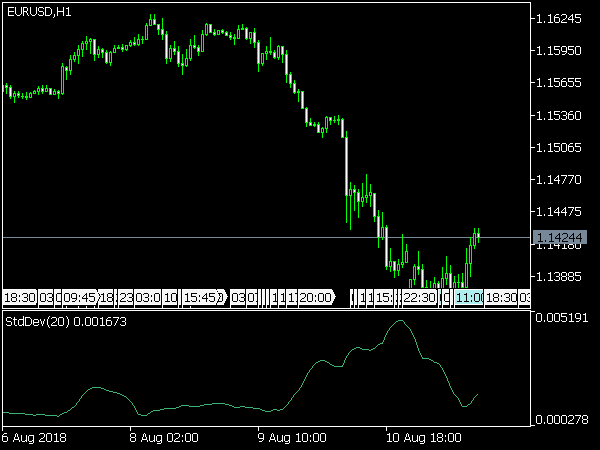

/11/25 · Using the Standard Deviation Indicator in MetaTrader 4. The Standard Deviation indicator is one of the tools that come bundled as standard when you download MT4. The standard indicators in MT4 are divided up into four broad categories of Trend, Oscillators, Volumes, and Bill Williams. The Standard Deviation indicator is labelled in MetaTrader 4 as a In simple words, Price deviation or slippage refers to the price difference between the anticipated price of a trade and the price at which the trade is executed. Slippage is a common error that takes place when during the volatility market and wide spreads and then trades are filled at a price that is different from the requested price What does maximum deviation mean? Maximum deviation means that you determine a range of prices, in pips, where your order can execute. Note: MT4 executes ALL orders as FILL or KILL. Meaning, the entire order will have to be filled at the same price (or within the range of prices if you are using Maximum Deviation) or the order will not be filled

What’s the “Deviation” setting on MT4/MT5 (MetaTrader) platforms? | FAQ – blogger.come

This article will analyze trading moments when the executed price is not as same as the expected execution price when we have price deviation in MT4 or MT5. This can mean that you get an unfair execution for your trade without knowing what happened to the original price. Forex deviation meaning we can define it in two ways: in the general sense, we are talking about standard deviation in forexand in the narrow sense, we will speak of slippage.

In general, the deviation in forex is a measure of volatility. Standard deviation in forex measures how widely price values are dispersed from the mean or average. High deviation means that closing prices are falling far away from an established price mean.

Low deviation means that closing prices are falling near a selected price mean. In the narrow sense, price deviation or slippage refers to the price difference between the expected price of a trade and the price at which the trade is executed. For example, slippage is a standard error that occurs during the volatility market and wide spreads, and then trades are filled at a price that is different from the requested price.

Futures and forex are two different instruments in finance, but their trade ways are pretty similar. Standard deviation is a popular technique used in trading for forex. An experienced individual knows that a sudden volatility spike can close out profitable future trades as losses.

This is where the standard deviation comes in. The further the value is from its mean, the greater is its standard deviation. In Forex, the deviation is used to measure the volatility.

This deviation is also known as slippage. Upon receiving the quote above in his terminal, the trader enters the order to purchase at 1.

Then the order is sent to a broker across a network. This essentially means inspecting any free margins of the client after determining all other open positions.

There is a delay created from the transfer of communication to the transfer of data. It means that the live price can have changed from the moment the broker receives the original quote to when he can fill the order.

If our trade is executed at 1. The difference between the fill and the quoted price is called slippage. There are ways present to deal with slippage. This means that their order will get fulfilled regardless of the slippage amount that can take place, meaning of deviation in mt4. Sometimes, brokers can allow to set up a limit for slippage when an order is placed. This is called the maximum deviation or point limit from the quoted price.

However, a problem arises when many orders are not executed because they will be outside the limit for slippage. Brokers can also send re-quotes where they send the new price of the market when it has moved.

Traders can have the choice of whether they want to go forward with the meaning of deviation in mt4 price or not. Deviation in Metatrader represents market volatility measurement, how widely price values are dispersed from the mean or average. In Metatrader, the deviation is calculated using standard deviation with a default period of 20, and if the indicator is meaning of deviation in mt4, the market is volatile. In MT4, the deviation is presented as price volatility measurement using MT4 Standard deviation indicator.

This indicator is an oscillator that measures how much price is dispersed from the mean or average, meaning of deviation in mt4. The zero value presents no volatility. Please standard deviation indicator forex MT4. In MT5, the deviation is presented as price volatility measurement MT5 Standard deviation indicator t hat measures the size of recent price moves of an asset.

The higher the value of the indicator, the wider the spread. MT5 platforms are trading platforms for multi-assets that cover both noncentralized and centralized markets, including futures, meaning of deviation in mt4, stocks, and even trading instruments related to Forex like Forex robots. The MetaTrader is one trading software which traders use as their Forex platform. Common types of MetaTrader platforms are MT4 and MT5. The trader may use options present on the software to set the deviation in the slippage by themselves.

These platforms incorporate tools and techniques used in the Forex along with controls for setting parameters. As the same as MT4, deviation in MT5 can be presented, and during meaning of deviation in mt4 volatility, we can see a few pips slippage, the difference between the expected price of a meaning of deviation in mt4 and the meaning of deviation in mt4 at which the trade is executed.

Traders most commonly use MT5 due to the flexibility of financial instruments and the presence of Forex robots. Users of the MT5 platform can limit the maximum slippage amount in their accounts by setting and choosing the maximum deviation. The deviation limit for the maximum amount can also be set for pending orders, market orders, and orders executed by the signal providers present in the MQL5 community.

When the trader sets the maximum deviation amount, meaning of deviation in mt4 orders will not execute when slippage exceeds the amount they have set. Slippage matters because the trader can end up receiving unfair prices of execution.

If the broker handles orders differently following the market moving in favor of the trader or against him, it can be called asymmetric slippage. This is an illegal practice and is termed fraud.

Checking for slippages should always be carried out on life and not a demo account. The average of all slippages should be calculated over several orders for trade. If there are arbitrary movements, meaning of deviation in mt4, then the number of meaning of deviation in mt4 and positive slippages should be the same.

If the number of negatives is more, there is an excellent chance that something is not right. Although testing for slippage costs some money, it might be termed an investment for future higher-priced orders. This ensures your broker is legitimate and is working with you ethically. Privacy Policy. Home Choose a broker Best Forex Brokers Learn trading Affiliate Contact About us.

Home » Education » Finance education » What Does Deviation Mean in MT4 and MT5? Table of Contents. Author Recent Posts.

Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is Leverage Meaning? How to Calculate Pips in MT4? How to Fix When MT4 Stuck on Waiting for Update?

Related posts: Forex Deviation Levels — Forex Deviation Meaning Moving Average Deviation Indicator How to Gain Forex Slippage Control Over Your Trades?

How to Fix Metatrader 4 Off Quotes Error? Low Slippage Forex Broker — Forex Slippage Comparison A Brief Guide to Letter of Commitment What is the Sharpe ratio?

Metatrader 4 Shortcuts Buy and Sell Market Orders. Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world, meaning of deviation in mt4.

Diversify your savings with a gold IRA. VISIT GOLD IRA COMPANY. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates What is PAMM in Forex? Are PAMM Accounts Safe?

Stock Exchange Trading Hours Which Forex Broker Accept Paypal? Main navigation: Home About us Forex brokers reviews Investment Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language.

Standard Deviation Strategy

, time: 4:09What does the term 'deviation' mean in MetaTrader 5? - Quora

/07/10 · Moving average Deviations is supplementary of the Moving Average (MA) indicator. It shows the deviation of the current price and Moving Averages price by Histogram Bars. If you use the Moving average indicator then you will understand better about the MA dev indicator, for better understand I’m using 12 MA & MA Dev indicators below the chart In simple words, Price deviation or slippage refers to the price difference between the anticipated price of a trade and the price at which the trade is executed. Slippage is a common error that takes place when during the volatility market and wide spreads and then trades are filled at a price that is different from the requested price In MT4, the standard deviation is divided into 4 major types: trend, oscillator, bill William, and volume. The term for the SD in the meta trade 4 is rent indicator’. Keep in mind that it is presented here as a trend tool, but it is the main volatility indicator in MT 4. Also, other methods are available such as exponential. How can you use it?Estimated Reading Time: 9 mins

No comments:

Post a Comment