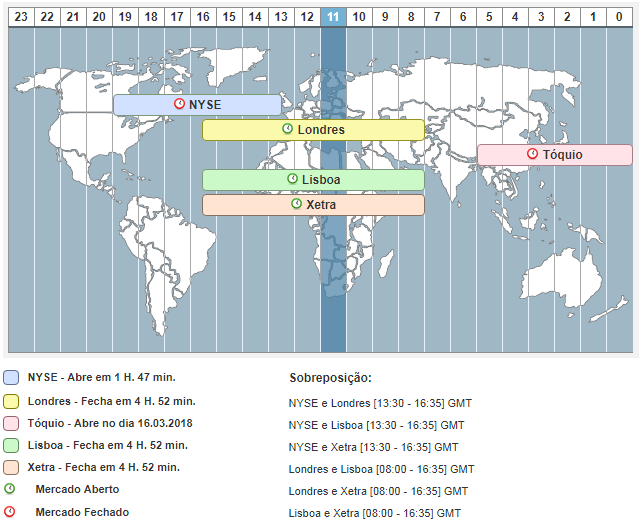

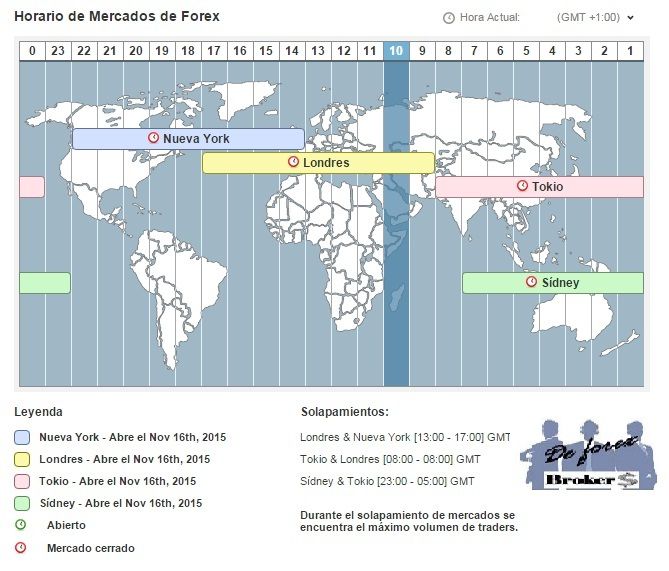

Haga clic en cualquier fila (no en el nombre del instrumento) y se desplegará para mostrar todas las especificaciones, incluido el horario de negociación. Los gráficos pueden tener a veces diferentes horarios de apertura y cierre como se indica a continuación Divulgação de riscos: A realização de transações com instrumentos financeiros e/ou criptomoedas envolve altos riscos, incluindo o risco de perda de uma parte ou da totalidade do valor do investimento, e pode não ser adequada para todos os investidores. Os preços das criptomoedas são extremamente voláteis e podem ser afetados por fatores externos tais 10/07/ · El mapa de bolsas de valores muestra las horas de trading para los principales comercios globales de acciones. La columna azul oscura indica el intervalo de tiempo actual en ambos mapas, y la zona horaria utilizada es la GMT. Usa la herramienta debajo de cada mapa para obtener información acerca de la apertura y cierre de mercados

Conoce Los distintos Horarios Mercados Financieros - Vivo del Trading

Instead, we require our money to make more money, which is one method of describing what investing is. When you invest, you use the power of substance interest, investing horarios de mercados. This basic mathematics formula can make it simple to determine what your prospective returns might appear like. Rather than attempting to comprehend the nuances of such a calculation, this tried and true faster way could prove to be important.

There are so many ways to invest your money that it can feel rather overwhelming to many novices. We have actually assembled a list that includes 4 of the very best choices that fit these criteria.

Stocks or equities are shares of a company that you preferably purchase low and offer higher. Some concentrate on a particular investing horarios de mercados like large-cap companieswhile others track specific indexes. Created to offer diversity, they are less dangerous than specific stocks, given that your money is spread throughout several financial investments instantly. The biggest of these is how they trade.

When investing horarios de mercados purchase a shared fund, you do not actually know what price you are paying, investing horarios de mercados.

ETFs, on the other hand, trade like stocks, meaning you can see the price as they vary throughout the day. In turn, you can set the price you want to pay beforehand. There are no minimums for these securities, though your brokerage might charge a commission per trade. Others track collections of stocks that concentrate on markets like healthcare, technology or agriculture.

Fixed-income securities consist of a number of different types of securities, such as U. Treasury bonds, investing horarios de mercados, corporate bonds, local bonds and CDs.

Usually, the longer the period, the higher the investing horarios de mercados of interest. While the potential for development is low, these investments are reasonably safe. Naturally, some business bonds are bigger threats than others. This happens if rates unexpectedly leap up. People want to dump their bonds so they can get the greater interest rate. You will not lose cash on your bonds if you can hold them to maturity. If you need or desire to sell them, you might lose cash.

Of all the fixed-income securities pointed out here, CDs are typically the safest. You can take your money and put it into a second house or an financial investment home. Renting multiple properties can help you achieve an intensifying effect on your general month-to-month earnings.

If you choose the area of the property well then holding it as a possession for multiple years can imply a great increase when you offer it one day. Many individuals believe that realty is the most steady investment a beginner can make — keywords, investing horarios de mercados.

Those who go after the highest returns invest most heavily in stocks. On the other hand, if you are averse to risk or hesitate to invest in equities, you may stick to ETFs, shared funds, or bonds. This conscious choice leaves you open to the possibility of lower returns than if you invest mostly in stocks.

When you diversify, you buy multiple sectors of the marketplace to protect yourself from sharp decreases. This might include buying both domestic and foreign securities and combining risky and safe investments in percentages that finest align with your danger tolerance, investing horarios de mercados. The decision in between a high-risk, high-return investment method and its equivalent must depend, in part, on your investing time frame.

But some investing horarios de mercados make that shift too soon, missing out on the gains that they require to keep their financial investments growing and make it through retirement. With individuals investing horarios de mercados longer in retirement and therefore needing more retirement earnings, experts are shying away from recommending that anybody eliminate their equity direct exposure too soon.

They can assist with plenty of other financial planning services, such as: Retirement preparing Education fund planning Tax preparation Estate preparing Insurance planning Budgeting Philanthropic present preparation There is no perfect amount of money to have prior to you begin investing unless there is a minimum quantity you should have to purchase your preferred financial investment like real estate. Thanks to the tech industry, investment has actually never ever been so accessible.

You can begin with as low as a couple hundred dollars and just gradually include to your overall investment with time. What Investing horarios de mercados Investing? Put broadly, investing is the creation of more money through the usage of capital. There are various kinds of financial investments consisting of stocks, investing horarios de mercados, bonds and real estate and each includes its own level of threat.

Among the core principles of investing is that you must take on a certain level of risk in anticipation of a future return. This makes it various from trading, which is the active trading of investments, and from spending, which is an exchange of capital for items and services without the potential for future returns.

Kinds of Investments When you open a financial investment account, you can put your money into any variety of cars: Buying mutual funds, exchange-traded funds and bonds are all choices. Review these types of investments and see if any fit your needs. Stocks When you start buying stocks, you are purchasing a small portion of a company. The value of your stock exchange financial investment rises and falls as the business succeeds or stops working, investing horarios de mercados.

You can likewise make and lose cash based upon market patterns, amongst investing horarios de mercados aspects. With time, investing horarios de mercados, the bond allotment will be increased while the stock allowance will go down, therefore making the financial investment more conservative.

Index Funds An index fund is a passive method to acquire exposure to investing horarios de mercados specific stock exchange index. Expenses To Start Investing Although expenses continue to trend lower in the investing world, there are a number of types of charges, minimums and investing horarios de mercados you might face when you begin to invest.

Account Minimums Some brokerage companies need larger minimums than others to open a brand-new account. Among the best investment tips for beginners is to take a risk-tolerance quiz to help you figure out how much danger you can reasonably handle when you invest. A test will ask you concerns regarding how you invest and save money and what you would make with a windfall. If you plan to work with one, make sure they are a fee-only financial consultant. A robo-advisor is an online wealth management service that uses financial investment recommendations based upon algorithms.

By regularly contributing even percentages to a savings account, you can begin getting in the routine of setting money aside. With time, try to increase your contributions by living off a smaller sized quantity of your earnings. Often, your investments will recover.

Invest Just What You Can Afford The entire property of investing is that you need to accept some danger in order to create a return. Where there is risk, there is the potential for loss. Stock Market Investing for Beginners by Peter Matera Audiobook Audible. What is Investing?

A Simple Explanation for Kids and Teens. How Does Investing Work News How To Get Started Investing How To Start Investing In The Stock Market News How To Start Stock Investing Where To Start Investing News Articles gold buyers Cleveland pawn shop Stuart FL Gold Refineries Nyc Best Cheap Renters Insurance Quotes Bitcoin Toronto qualified opportunity zone Orange County Best Family Neighborhoods In Seattle Best Way To Invest Money Canada Lemon Car Law Related Articles © jackstevison.

¿COMO SABER CUANDO COMIENZA LA SESIÓN AMERICANA/SESIÓN EUROPEA? - HORARIOS FOREX [Parte 1]

, time: 1:32How Does Investing Work in - How Does Investing Work

To make the round journey (trading) on these 5 stocks would cost you $, or 10% of your preliminary deposit quantity of $1, – Investing Mapa De Los Horarios De Apertura De Mercados. If your financial investments do not make enough to cover this, you have actually lost money simply by getting in and exiting positions Sidney y Tokio: de a (GMT) Nueva York y Londres: de a (GMT) Londres y Tokio solo coinciden abiertos de a (GMT) Las oportunidades de picos aparecen cuando negocias con pares de divisas de dos mercados que están abiertos simultáneamente. Por ejemplo, para el caso de los horarios de mercados bursátiles Haga clic en cualquier fila (no en el nombre del instrumento) y se desplegará para mostrar todas las especificaciones, incluido el horario de negociación. Los gráficos pueden tener a veces diferentes horarios de apertura y cierre como se indica a continuación

No comments:

Post a Comment