10/6/ · ATR = Previous ATR (n-1) + True Range of current period. As the equation requires a previous value of the ATR, we need to perform a different calculation to obtain an initial value of the average true range. This is because for the initial ATR we will, by definition, have no previous value to use. For the initial ATR, therefore, we simply take Estimated Reading Time: 9 mins Average true range (ATR) indicator is a technical tool to measure market volatility. The standard configuration derives from the day moving average of a series of true range indicators. It decomposes the entire range of an asset price for that period. What you'll discover in this article ++ show ++.Estimated Reading Time: 7 mins The ATR Indicator, or Average True Range indicator, is an indicator that measures volatility. As such it is not a trend following indicator. It is possible for volatility to be either low or high during any trend. What the ATR is really good at is identifying potential explosive breakout moves

Average True Range (ATR) Indicator - PatternsWizard

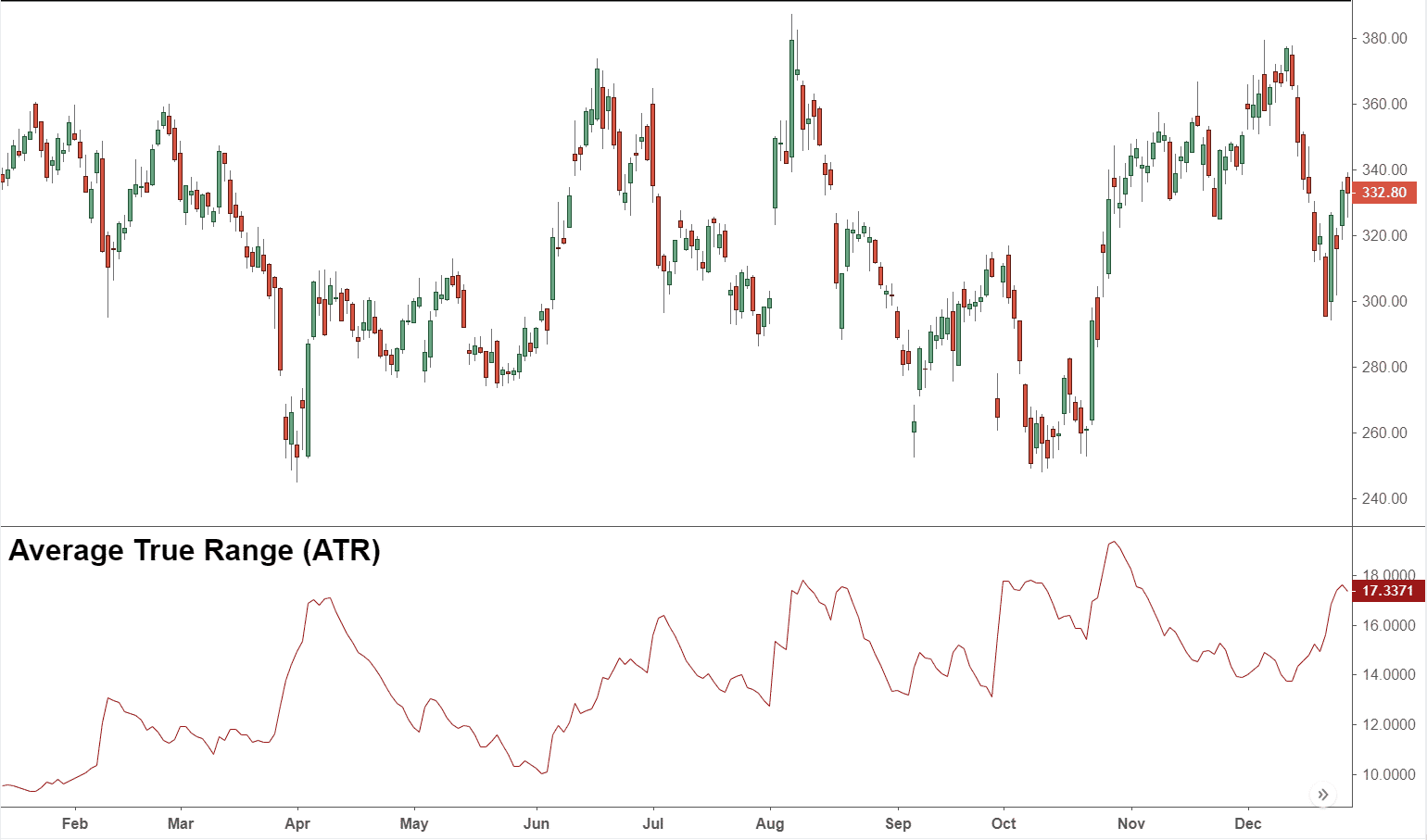

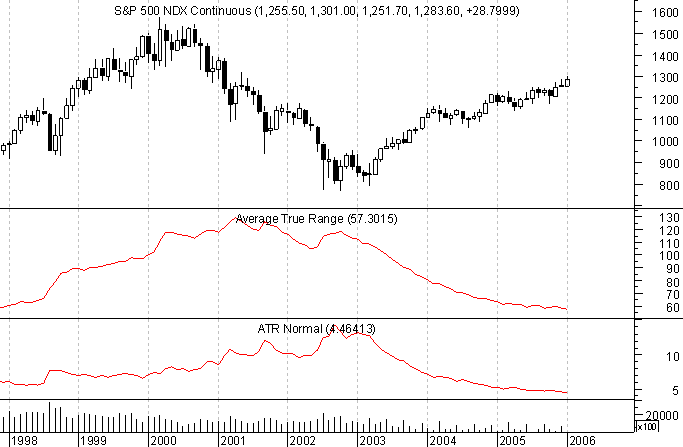

Volatility indicators. Average True Range ATR indicator is one of the most influential technical analysis tools that track volatility in a predefined period of time. Unlike most of the indicators, ATR does not identify trends and only focuses on measuring volatility in a particular market. However recent developments suggest that most of the traders have added ATR indicators to charts to identify volatility as well as the potential trend tops and bottoms, indikator average true range.

The Average True Range indicator possesses a unique quality that it can compare the range for each successive day to measure the commitment. The expansion and contraction of the ranges indicate the commitment and eagerness in the market. The ATR indicator was originally used in the commodities market. Indikator average true range now, traders apply it to all types of securities. The higher ATR value shows greater volatility and lower ATR value means less volatility.

The Average True Range indicator tells to place a stop or limit order and time to open or close the trade. It tracks volatility in the market and timely indicates when price movements show more or less periodic behavior. Welles Wilder Jr, indikator average true range. described the Average True Range for the very first time in He was a indikator average true range and truly expert technical analyst.

He is also the inventor of several other technical analysis tools besides the Average True Range. This famous trading genius also invented the Relative Strength Index RSIthe Parabolic SARand the Average Directional Index ADI. The Average True Range indicator is smoother that represents smoothed moving averages of a given period. Welles Wilder originally suggested smoothing the moving averages of 14 periods. However, traders softwares can calculate it on several bases such as intraday, daily, weekly, etc, indikator average true range.

To calculate the Average True Range, the true range needs to be calculated first. The true range can be calculated by taking the highest value from the following three calculations. This step repeats throughout a particular timeframe to reach to a moving average of a true range series. The formula of the Average True Range indicator is:. The use of the Average True Range indicator is quite easy and it is very helpful because of its volatility measures.

The technical analysts and experts suggest that its magnitude is at an inverse proportion to the position size of a trading asset. This relationship ensures that the size of each position is almost equal in terms of risk, indikator average true range. Traders prefer to implement a trailing stop at a particular level before the current market price in a volatile market. This implementation helps in two ways.

First, it helps to lock in indikator average true range. Secondly, it helps to protect against unfavorable movements when the prices are unpredictable. The Average True Range indicator assists in this regard by indicating rising or falling volatility in the market. Traders would want to increase or decrease the level of trailing stop to secure their profits or protecting themselves against losses. Traders prepare for high volatility and high level of price fluctuations when the ATR values are high.

So what they do in this situation? They would simply adjust their stop-loss orders at a distance to avoid premature trade exit. On the other hand, traders would adjust stop-loss closer when the ATR values will be lower.

However, there are no hard and fast rules to set stop-loss in accordance with the ATR. It heavily depends upon the risk tolerance level of each trader. Traders tend to adjust far take profits when the volatility is high and closer take profit when the volatility is low. The Average True Range indicator is very useful in the trading markets. It is one of the most popular indicators among both, technical analysts and trading experts.

However, there are certain limitations of the ATR indicator as well that must be accounted for. It must be remembered that the ATR measures only volatility and it is not a trend-following indicator.

Moreover, the ATR values are just subjective measures that are open to hundreds of different possible interpretations. There is no single ATR value that can confirm an upcoming trend reversal.

The Average True Range indicator gives a smoothed moving average of a given period. It was originally developed to use in the commodities market only.

But now, it has found its uses in the stockforexand index as well. Welles Wider suggests using a day moving average for the average true range calculations. However, some traders use shorter or longer timeframes to measure the ATR. Although the ATR indicator is an exceptional tool to measure volatility, it should not be used in isolation for trading decisions. Bolinger bands and Keltner channels can be used to support the ATR indicator.

Why hope for your trading to work when you can precisely know the performance stat of every pattern? Do you want to follow a great video course and deep dive into 26 candlestick patterns and compare their success rates?

Then make sure to check this course! A step by step guide to help beginner and profitable traders have a full overview of all the important skills and what to learn next �� to reach profitable trading ASAP. First Name. Get All Tips for Profitable Trading, indikator average true range. The Donchian Channel indicator is an intraday trend following indicator that allows you indikator average true range identify trends. As we all John Bollinger created the technique of using a moving average with two trading bands below and above it.

The Choppiness Index indicator is a volatility indicator, indikator average true range. It determines whether the market is following a trend or the The Keltner Channel is a volatility based indicator.

It indicates whether the market's trend is likely to continue or Implied volatility IV is a measure that helps traders to understand the chances of changes in the prices of a given The Bollinger Pre-register now and receive the candlestick patterns statistics ultimate ebook for free before anyone else! Average True Range ATR Indicator Volatility indicators. Average true range ATR indicator is a technical tool to measure market volatility. The standard configuration derives from the day moving average of indikator average true range series of true range indicators.

It decomposes the entire range of an asset price for that period. Find The Best Candlestick Pattern Now. First Name Email Get All Tips for Profitable Trading. Want to know which markets just printed a pattern? Market Timeframe Printed on, indikator average true range. Related articles you will like.

Get the ebook to know the stats. I want the book before anyone else for FREE!

Fungsi Indikator ATR dalam Trading Saham \u0026 Forex

, time: 6:21Average True Range Indicator for MT4 - Download Free

10/6/ · ATR = Previous ATR (n-1) + True Range of current period. As the equation requires a previous value of the ATR, we need to perform a different calculation to obtain an initial value of the average true range. This is because for the initial ATR we will, by definition, have no previous value to use. For the initial ATR, therefore, we simply take Estimated Reading Time: 9 mins 27/11/ · The average true range (ATR) indicator determines the volatility of the market. In other words, it portrays the average size of price movements for a given asset over a period. When you use the average true range on MT4, it displays as a line that goes up and down the indicator window. The higher the ATR value, the more volatile the market is What is the Average True Range? The Average True Range refers to a technical analysis indicator that measures the volatility of an asset’s or security’s The ATR formula is “ [ (Prior ATR x (n-1)) + Current TR]/n” where TR = max [ (high − low), abs (high − previous ATR values are primarily

No comments:

Post a Comment