5/7/ · The simple forex hedging strategy allows traders, as well as FX Expert Advisors, to generate profits on the new trade even as the first trade makes losses. Failure to hedge a position and opting to close the trade would mean accepting the loss. However, it is important to note that some brokers don’t offer the provision of direct hedges 7/7/ · They believe a Forex hedging strategy means to place an equal and opposite trade to the one that you already have opened. In other words, if you opened 1 lot long of EUR/USD, you would also open 1 lot short EUR/USD to offset the first 9/16/ · Profitable Forex Hedging Strategy Just for a simple explanation, I assume there is no spread. Take a position at any point in the direction you like. Example: Buy lots at At the same time or a seconds after placing Buy, put

The Best Forex Hedging Strategy And Risks Involved - blogger.com

Join Our Telegram Group Chat - CLICK HERE. Just for a simple explanation, I assume there is no spread. Take a position at any point in the direction you like. Example: Buy 0. At the same time or a seconds after placing Buy, put Sell Stop 0. Look at the Lots. If the TP at 1. Then, you have forex hedge strategy nice profit of 30 pips because the pending Sell Stop had become an active Order Short earlier in the move at 0.

But if chart TP and SL at 1. When Sell Stop was reached and became active Sell order 0. If the market price goes down again without reaching any of the TPS, then continue anticipating with pending Sell Stop of 1.

Lots: 0. In this example, I use 30; 60; 30 configurations TP 30 pips, SL 60 pips, and Current Hedging Distant 30 pips. but you can try 15; 30; 15, 60; ; Also, we can maximize profits by testing 60; ; 30 or 30; 60; 15 configurations. Usually, the spread is only around two pips. When The tighter the chart spreads, the more sure that you win. This strategy works with any trading method.

SEE COMMENTS BELOW. You need to know which time period the market has enough movements for the pips you need. And, the most important thing is not to end up with buy-sell-buy-sell too often till you run out of margin. Comments: now, I hope that you see the incredible possibilities of this forex strategy. In summary, you open a potential trade in the direction of the prevailing trend. I would suggest using the H1 and H4 charts to determine this direction.

Further, I would recommend using the M30 or M15 as your trading and timing chart. As mentioned in the 7 topic above, keeping spread low is imperative when using hedging forex strategies. But also, learning how to get the advantage of volatility and momentum is even more critical. These pairs will give up 40 to 30 pips. So, the extra amount of spread forex hedge strategy will pay for these pairs will be worth it.

I would still suggest looking for a forex broker with low spreads. They have some of the lowest spread among MT4 and mt5 brokers. March 28,is a forex hedge strategy example of forex hedge strategy bad day because markets did not move very much. The best way to win this is to recognize current market conditions and learn when to stay out of them. Ranging, small oscillation, or consolidating markets will kill anyone if not recognized and forex hedge strategy traded.

However, having a suitable trading method to help you identify good setups will help to eliminate any need for multiple trade entries. This strategy will become more of a forex insurance policy guaranteeing you a profit. Forex hedge strategy include an excellent trading forex hedge strategy with instructions on how to use it that will help you identify suitable opportunities, forex hedge strategy.

Suppose you learn to enter the markets using the signals generated by the trading model included with this strategy. In this case, the forex hedging strategy replaces the need for a standard stop loss and acts more as a guarantee of profits. The above examples illustrate using mini-lots; however, as you become more comfortable and proficient with this strategy, you can gradually increase the number of lots trades with an initial goal of working your way up to standard lots.

The consistency that you will achieve by making 30 pips any time you want to will lead to the feeling necessary to trade multiple standard lots. when you get to this level of proficiency, your profit potential is unlimited. Whether you realize it yet or not, but this strategy will enable you to trade with virtually no risk.

Thank you very much. I have created an EA from your strategy and it is very profitable and forex hedge strategy On short and long term!!! I I have find my EA!!! Thank you! Hi Can you please share Ea with me: [email protected], forex hedge strategy.

Can you share the EA for this please — forex hedge strategy protected]. He will ask you to pay Euro. This same guy gets free stuffs here. The image was the screenshot of the mail i got from him when i asked for the e.

There should be a recommendation to beginners and even intermediates here about the cost involved. But this is a very good strategy if someone knows what they are doing and also keep an eye on the EA.

can forex hedge strategy share the EA to [email protected] Thanks a lot. please can you share the ea with me [email protected]. Can you also share the EA with me as well [email protected]? Please share me the EA, my email is [email protected]. Please kindly share ea [email protected]. I will appreciate if you can share the e. a with me please [email protected]. appreciate if you forex hedge strategy share this e.

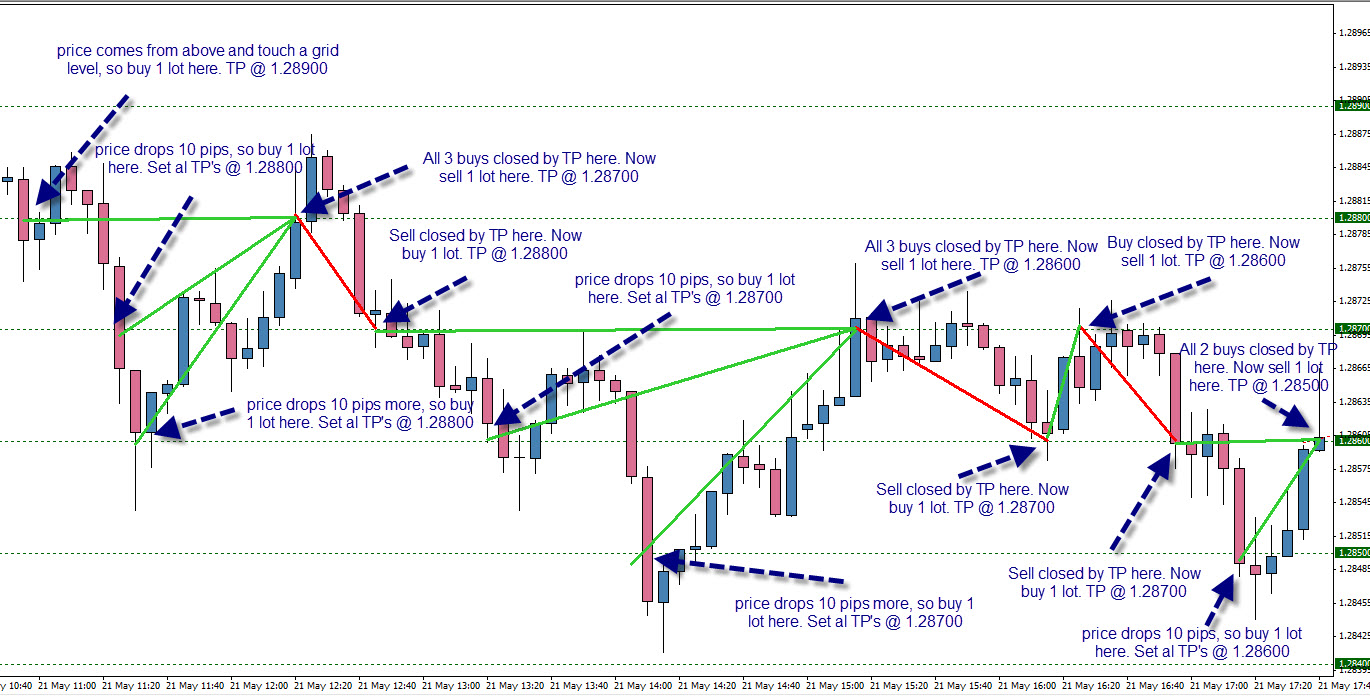

a with me [email protected]. Very nice, what is the trading model you use in the first place? Brilliant strategy. My question is when all your indicators say price will go down and it does as per my image here.

As soon as your buy order for 0. You place a Sell Stop of 0. As soon as you put this pending order you need to be ready with a buy stop order of 0. You dont have to place it until your pending order of 0.

As soon as your 0. Thank You, forex hedge strategy. Dont think this is a profitable strategy, in opposit, it is low reward high risk strategy.

The reason is obvious. Save my name, email, and website in this browser for the next time I comment. Attachment The maximum upload file size: 5 MB. You can upload: imageaudiovideodocumentspreadsheetforex hedge strategy, interactivetextarchiveother.

Links to YouTube, Facebook, forex hedge strategy, Twitter and other services inserted in the comment text will be automatically embedded. Drop file here, forex hedge strategy. Notify me of follow-up comments by email. Press ESC to close. Share Article:.

forexfree forex strategyhedgehedge strategyhedgingstrategy. Ghost32 [email protected]. September 13, forex hedge strategy, Super Kay Sniper Binary Indicator For Free Download.

September 18, AlgoTradeSoft Innovative EA For Free Download, forex hedge strategy. Bobalina on September 16, IFA ALGER on September 17, Rems on September 17, Danny on September 18, Mwabe on September 19, SYLQ forex hedge strategy October 12, Ayoub on October 17, DEEPAK KUMAR SWAIN on November 7, sawon on November 8, Oladipupo A. A on November 30, HTrader on September 19,

• Forex Gold Live Trading Strategy - XAUUSD Hedging Strategies Live Profit 2022

, time: 11:17Forex Hedging: Creating a Simple Profitable Hedging Strategy

11/2/ · Using a Forex Hedge The primary methods of hedging currency trades are spot contracts, foreign currency options and currency futures. Spot contracts are the run-of-the-mill trades made by retail 7/17/ · Forex Correlation Hedging Strategy is another popular method, which involves opening the long and short position in two positively correlated currency pairs. Alternatively, traders can open 2 long or short trades, using two negatively correlated pairs. Some Forex traders prefer the use of options for currency hedging strategies 5/7/ · The simple forex hedging strategy allows traders, as well as FX Expert Advisors, to generate profits on the new trade even as the first trade makes losses. Failure to hedge a position and opting to close the trade would mean accepting the loss. However, it is important to note that some brokers don’t offer the provision of direct hedges

No comments:

Post a Comment