There are two types of forex options available: call and put options. A call option gives you the right to buy a currency, while a put option gives you the right to sell a currency. Once you have placed a call or put option, you then have the options to buy or sell these currencies later 1 For share CFDs there is a commission charge on entry and exit of a trade. Access over 12, financial instruments Trade CFDs on our multi award-winning platform* Margins from % % automated execution Share CFD commissions from % 1 Extensive suite of risk management tools More about CFDsLocation: Houndsditch, London, EC3A 7BX · Trade Options on our Pro platform , 31 July By CMC Markets Learn how to use the new ‘Options’ feature in our Pro platform. Easily implement different strategies while creating your options contract. MetaTrader 4 Trade CFDs on one of the world's most popular platforms Open a live MT4 account Next Generation PlatformAuthor: CMC Markets

CMC Markets Review - Pros and Cons of this Broker in

Options contracts are similar to both futures and forward tradingalthough once these contracts have been put together, you are obligated to carry out their full duration, cmc markets options. A call option gives you the right to buy, a put option gives you the right to sell. FX options are, cmc markets options, for the most part, fundamentally driven by the same factors that drive cmc markets options underlying currency pairscmc markets options, such as interest rates, inflation expectations, geopolitics and macroeconomic data such as unemployment, cmc markets options, GDP, consumer and business confidence surveys.

There are two styles of options; European and American. The European-style option can only be exercised on the expiry date. The American-style option can be exercised at the strike price, any time before the expiry date.

FX option traders can use the 'Greeks' Delta, Gamma, Theta, Rhio and Vega to judge the risks and rewards of the options price, in the same way as you would equity options. The risk for an option buyer is limited to the cost of buying the option, called the 'premium'. An option buyer has theoretically unlimited profit potential. Conversely, for an option seller the risk is potentially unlimited, but the profit is cmc markets options at the premium received. FX option contracts are typically traded through cmc markets options over-the-counter OTC market so are fully customisable and can expire at any time.

Cmc markets options the cmc markets options options market, when you buy a 'call', you also buy a 'put' simultaneously. FX options are also available through regulated exchanges which are options cmc markets options FX futures, in which case it is simply a call or a put. These offer a multitude of expirations and quoting options with standardised maturities. When traded on an exchange, FX options are typically available in ten currency pairs, all involving the US dollar, and are cash settled in dollars, cmc markets options.

One of the most common reasons for using FX options is for short-term hedges of spot FX or foreign stock market positions. There are many bullish, bearish and even neutral strategies that cmc markets options be implemented with options contracts.

Spread strategies that are used in equity options can also be used with FX options, including vertical spreads, straddles, condors and butterflies.

An FX option can either be bought or sold. If you are bullish on the base currency then you should buy calls or sell puts, conversely if you are bearish you should buy puts or sell calls, cmc markets options. Explore the forex market through our award-winning Next Generation trading platform. We also offer trading on the internal MetaTrader 4 platform. We don't currently offer forex options on our platform but we do offer forex forward contracts, which are a very similar type of derivative.

What is options trading in the forex market? A forex option is a derivative product that provides the feature of utilising leverage and dealing in currencies without having to purchase the tangible currency pair. Find out more about leveraged trading here.

There are two types of forex options available: call and put options. A call option gives you the right to buy a currency, while a put option gives you the right to sell a currency. Once you have placed a call or put option, you then have the options to buy or sell these currencies later, cmc markets options.

Options can be bought or sold until the expiration date, and are considered low risk as you can withdraw your options contract at any point. Discover the ways you can trade with CMC Markets. What is the strike price in options? The strike price is the price that the holder of an options contract can buy call or sell put the currency should they wish to exercise the option contract. With forex call and put options, the strike price is only valid until the expiration date.

Try out cmc markets options spread betting demo account to practise your trading strategies. Try out a demo account to practise your trading strategies, cmc markets options.

Disclaimer: CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, cmc markets options, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

See why serious traders choose CMC. Get tight spreads, no hidden fees, access to 11, instruments and more. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how spread bets and CFDs work and whether you can afford to cmc markets options the high risk of losing your money. WAYS TO TRADE Retail trading Spread betting CFD Cmc markets options Alpha Price Plus Compare accounts Costs.

CMC PRO Institutional. Discover our platforms See cmc markets options platforms web platform Mobile apps metatrader mt4. Find your edge Learn hub News and analysis Trading guides Webinars and events OPTO OPTO sessions. Trusted by serious traders for 30 years Why choose CMC? CMC Careers CMC Group Best execution Support Contact us. Log in Start trading. Home Learn to trade Learn forex trading Trading FX options. See inside our platform. Start trading Includes free demo account. Quick link to content:.

What is FX options trading? How are FX options traded? Start with a live account Start with a demo. Access to FX options FX option contracts are typically traded through the over-the-counter OTC market so are fully customisable and can expire at any time.

Why trade FX options? FAQ What is options trading in the forex market? How do forex options work? FAQ: EN-GB MT4 What is options trading in the forex market? FCA regulated. Segregated funds. Learn more Includes free demo account. EMEA Deutschland España France Ireland Italia.

Norge Österreich Polska Sverige United Kingdom. APAC Australia English 简体中文. New Zealand English 简体中文. Singapore English 简体中文. NAFTA Canada English 简体中文.

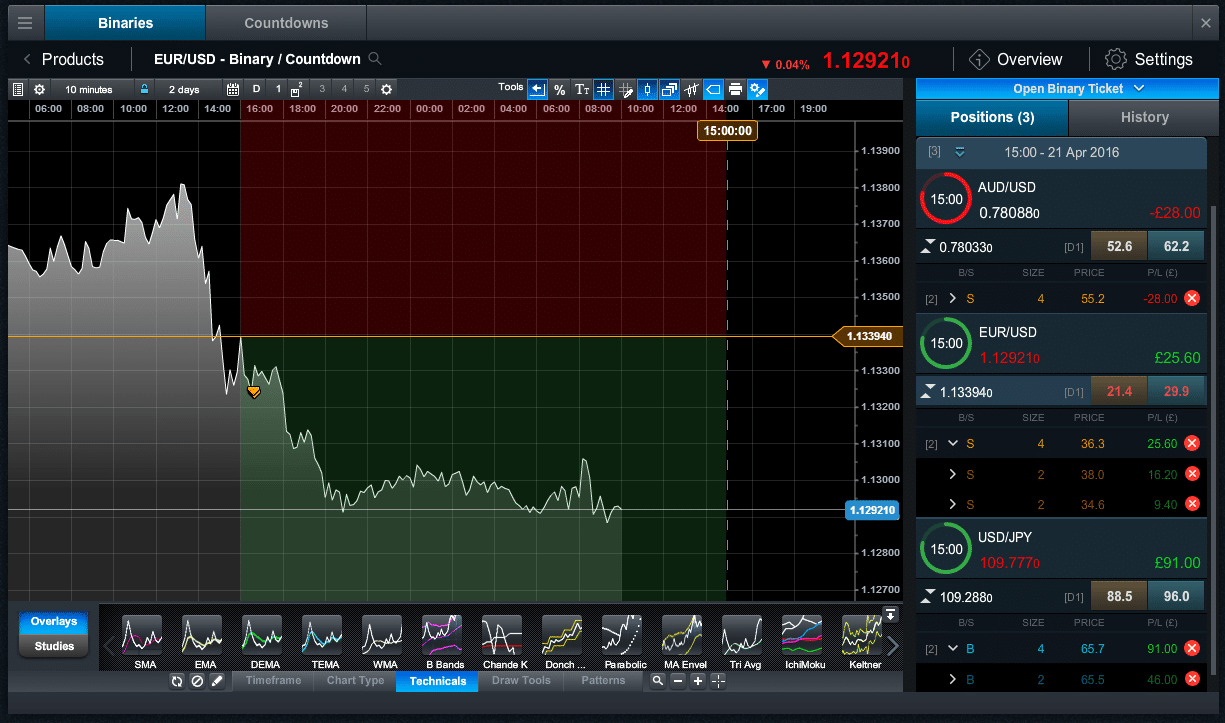

Trade Options on our Pro platform

, time: 3:29Options trading | CMC Markets

On the CMC Markets Invest platforms you can, depending on your trading level: Sell uncovered calls and puts. - Execute multi-legged options. - Build and execute complex strategies. - Understand your book with the Theoretical Price estimate and display of Options Greeks. - Use interactive pay-off diagrams to understand your risk and exposures There are two types of forex options available: call and put options. A call option gives you the right to buy a currency, while a put option gives you the right to sell a currency. Once you have placed a call or put option, you then have the options to buy or sell these currencies later No, you cannot trade options at CMC Markets. Since CMC Markets doesn't offer options, you might want to find an alternative broker by reading our article about the best brokers for options or alternatively, use our Find my Broker tool for a tailored recommendation. Author of this article Bence András Rózsa is an experienced broker analyst

No comments:

Post a Comment